Long Term Pricing in the Power Market (several clients)

World region: South Asia

Sector: Renewable energy developers and large consumers

Year: 2020 – 2023

Impact: Financing approved, some had to be reassessed

The electricity market in South Asia is growing at a very high pace to meet demand growth and the needs for decarbonization. Both lenders and investors require a financial assessment of the projects including an estimation of returns, and an identification of the main sources of uncertainty and to which extent these could compromise debt service.

The electricity market in South Asia is growing at a very high pace to meet demand growth, averaging 5% p.a. in the last decade, and also the needs for decarbonization, where just India is targeting 500 GW of renewables by 2030, growing from 167 GW in 2023. Meeting these ambitious targets would require mobilization of more than $40 Bn in investment annually for the next 7 years.

Both lenders and investors require a financial assessment of the projects including an estimation of returns, and an identification of the main sources of uncertainty and to which extent these could compromise debt service.

This assessment have served multiple purposes:

(1) Identify the projects that aren’t expected to be profitable to either cancel them or postpone them

(2) Quantify the impact of the main risk sources and develop risk mitigation strategies

(3) Optimize project design in terms of engineering and financing structure

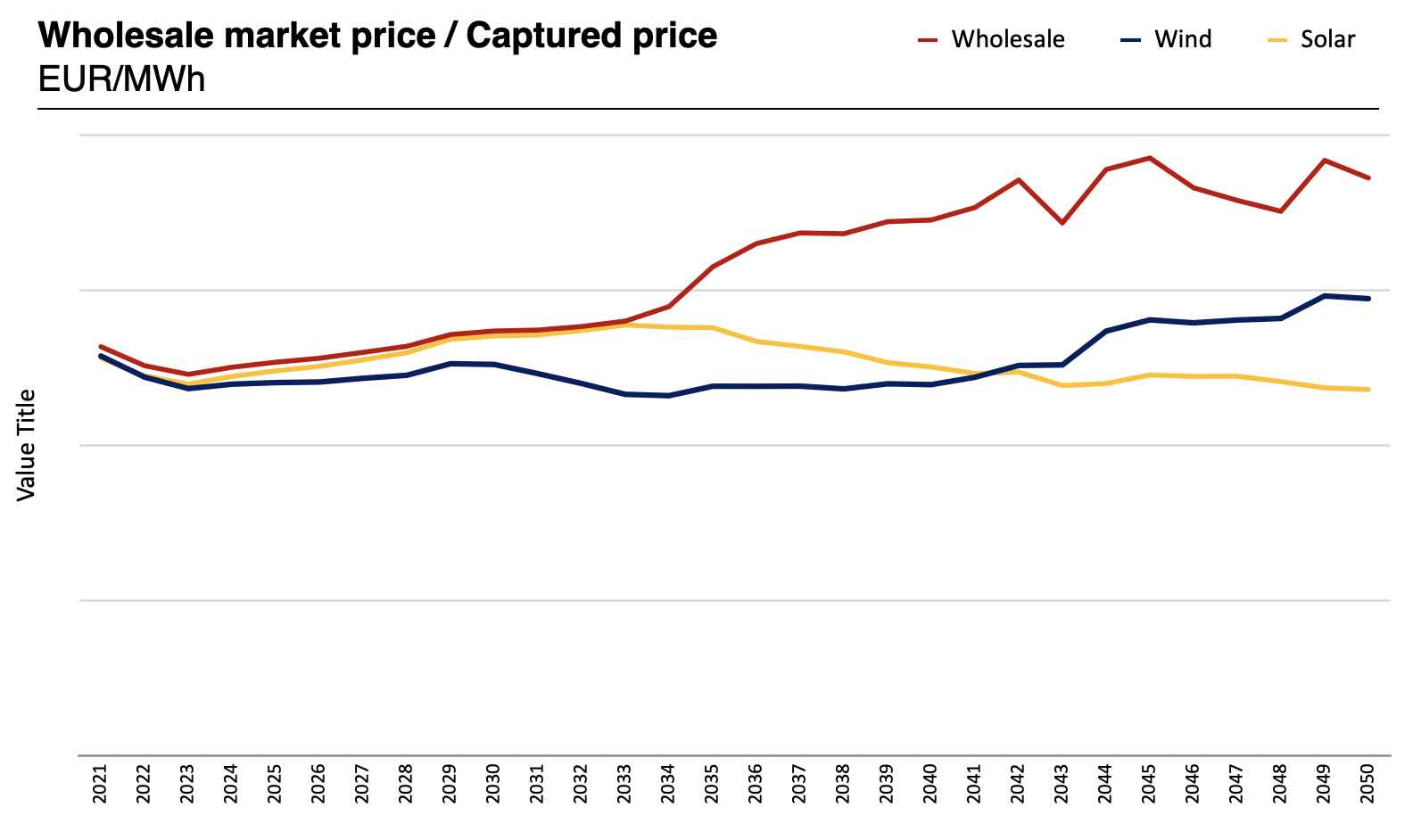

Wholesale market price / Captured price

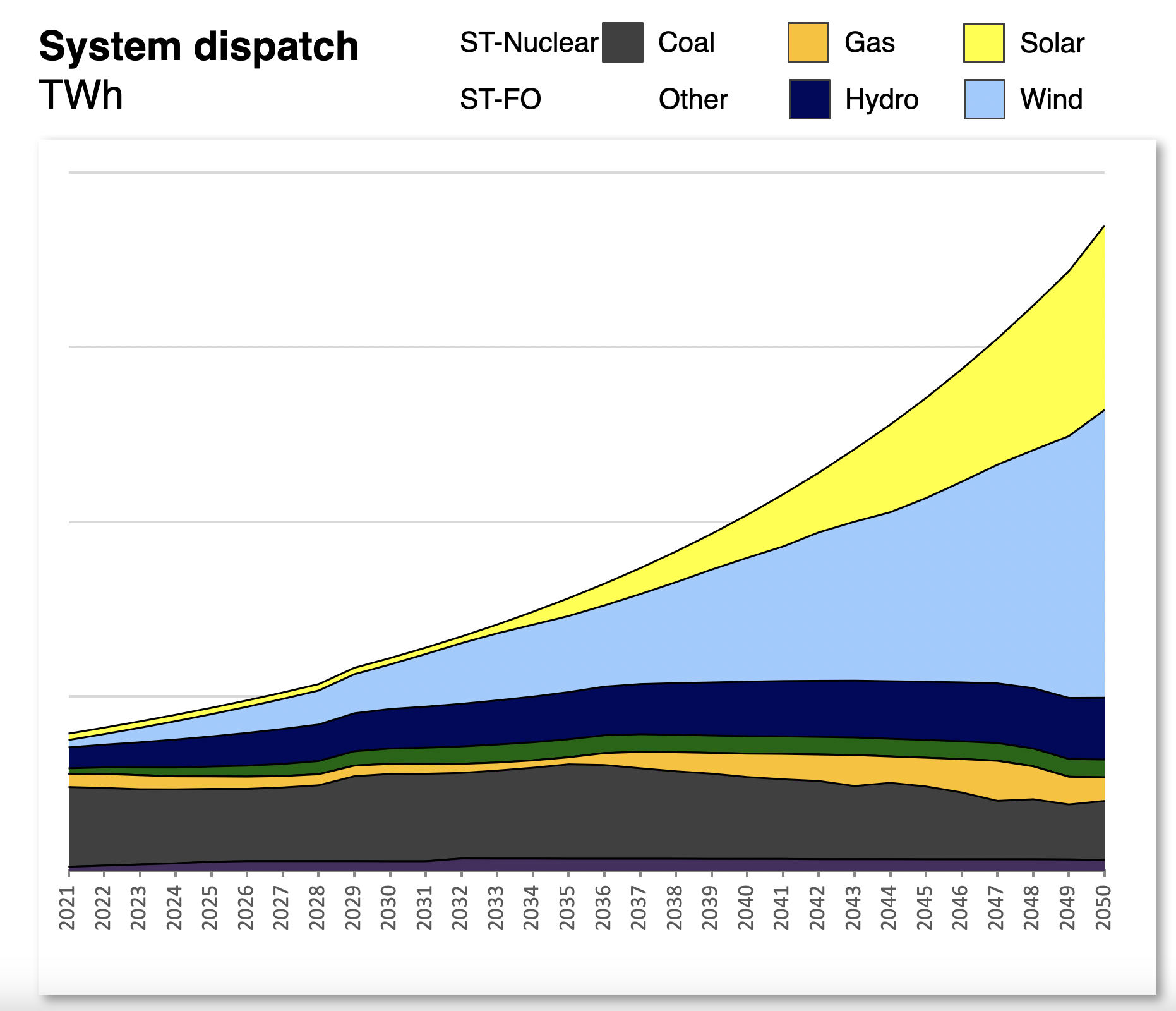

System dispatch – TWh