Market assessment of 500 MW reversible hydropower project

World region: Southeast Europe

Sector: International Financial Institution (IFI)

Year: 2019

Impact: € 90 Mn

Market assessment of a proposed reversible pumped storage power plant in Southeast Europe to assess its bankability. Besides original assessment, where we recommended adding the existing facilities as additional collateral, we identified the main market risks as well as the optimal power plant dimensioning which combined delivered an extra value of € 90 Mn.

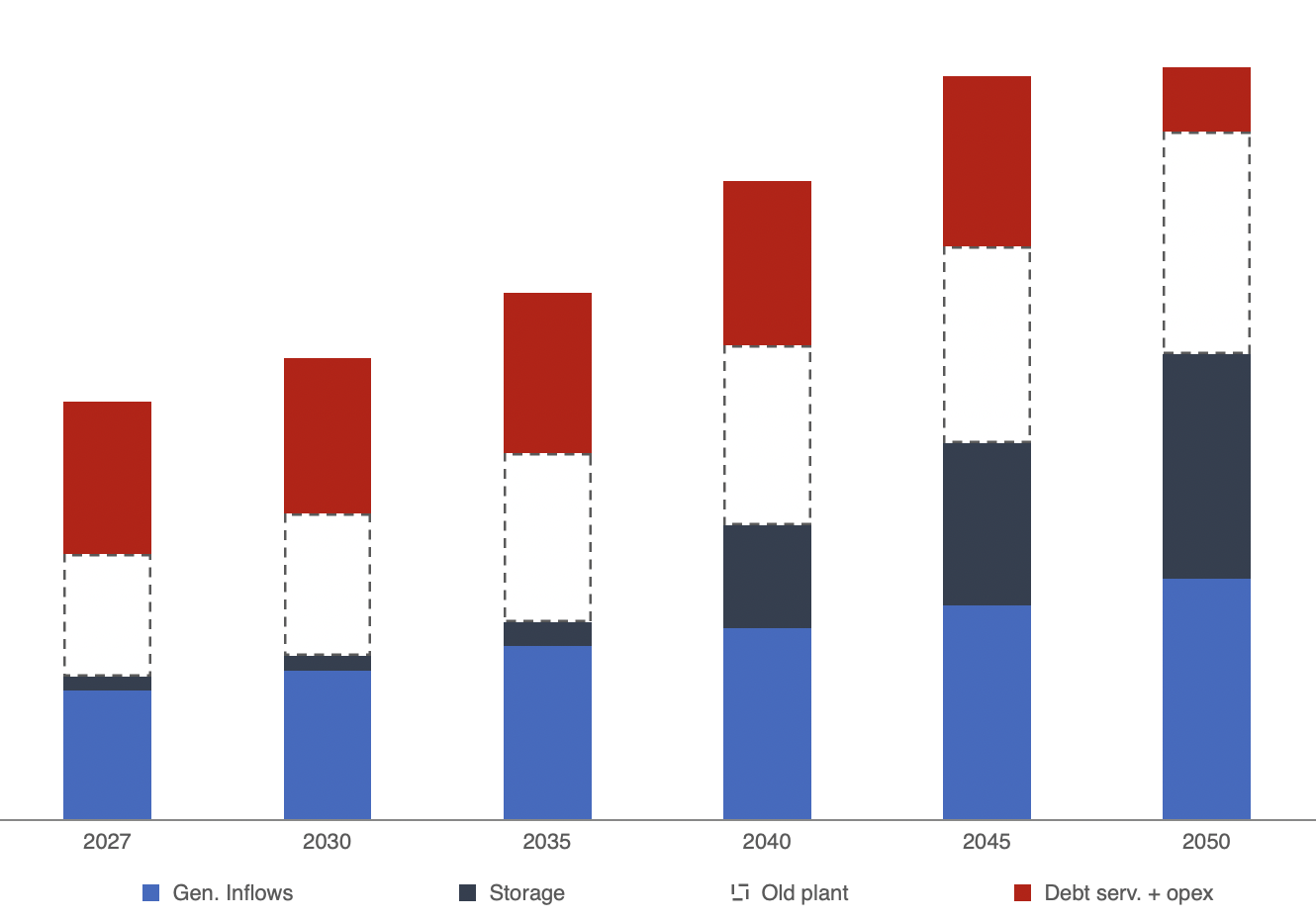

We carried out the quantitative analysis of the market returns of a proposed reversible pumped storage power plant in Southeast Europe to assess its bankability. Besides the profitability and bankability assessment, where we recommended adding the existing hydropower facilities as additional collateral to ensure the minimum debt service coverage ratio, we identified the main market risks as well as the optimal power plant dimensioning.

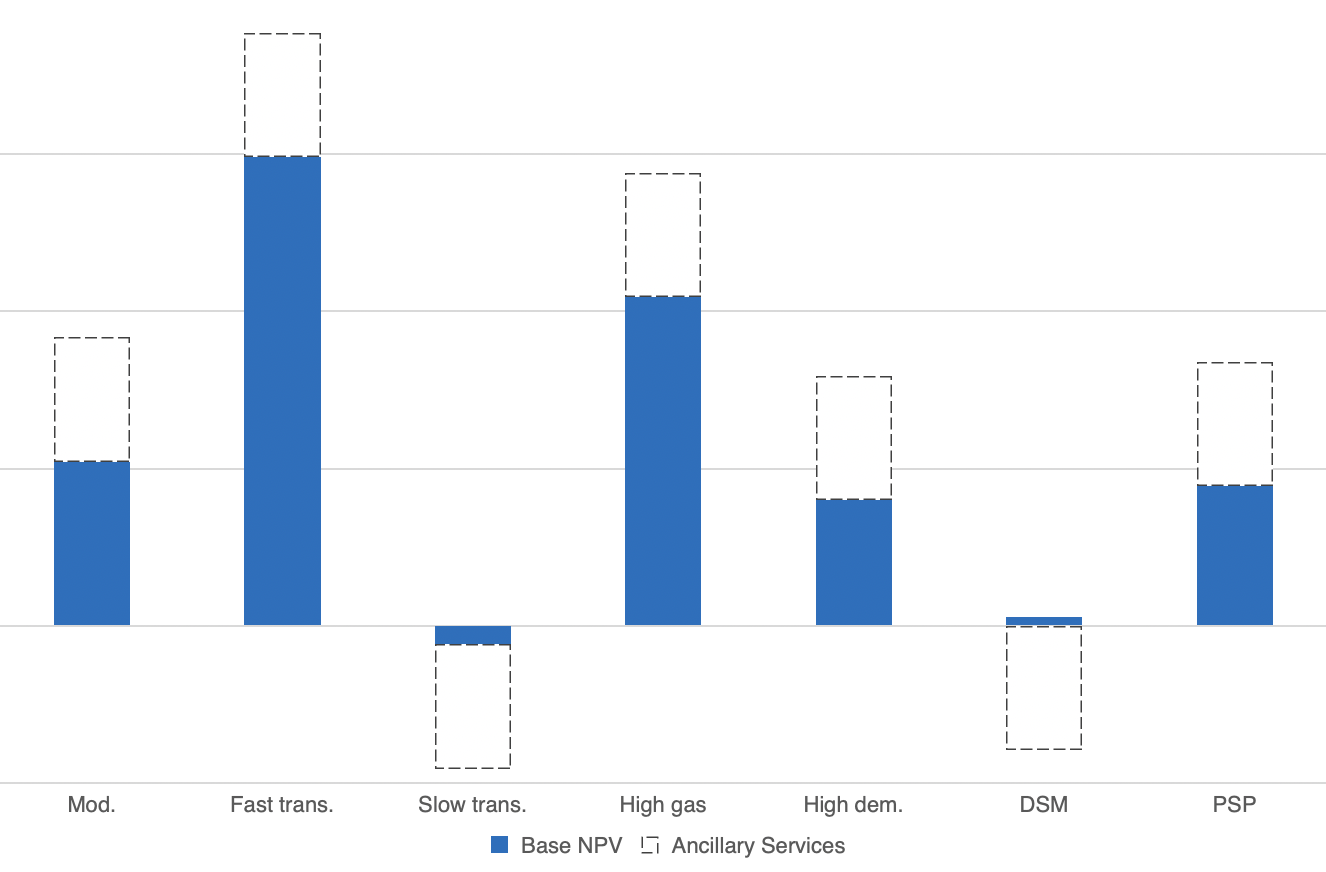

Though the project delivered positive net present value for most market scenarios, we identified that for the case of a stagnant development of renewables or in case of a widespread development of demand side management measures, such as electric vehicles with controlled loading the project’s returns would be below the cost of capital.

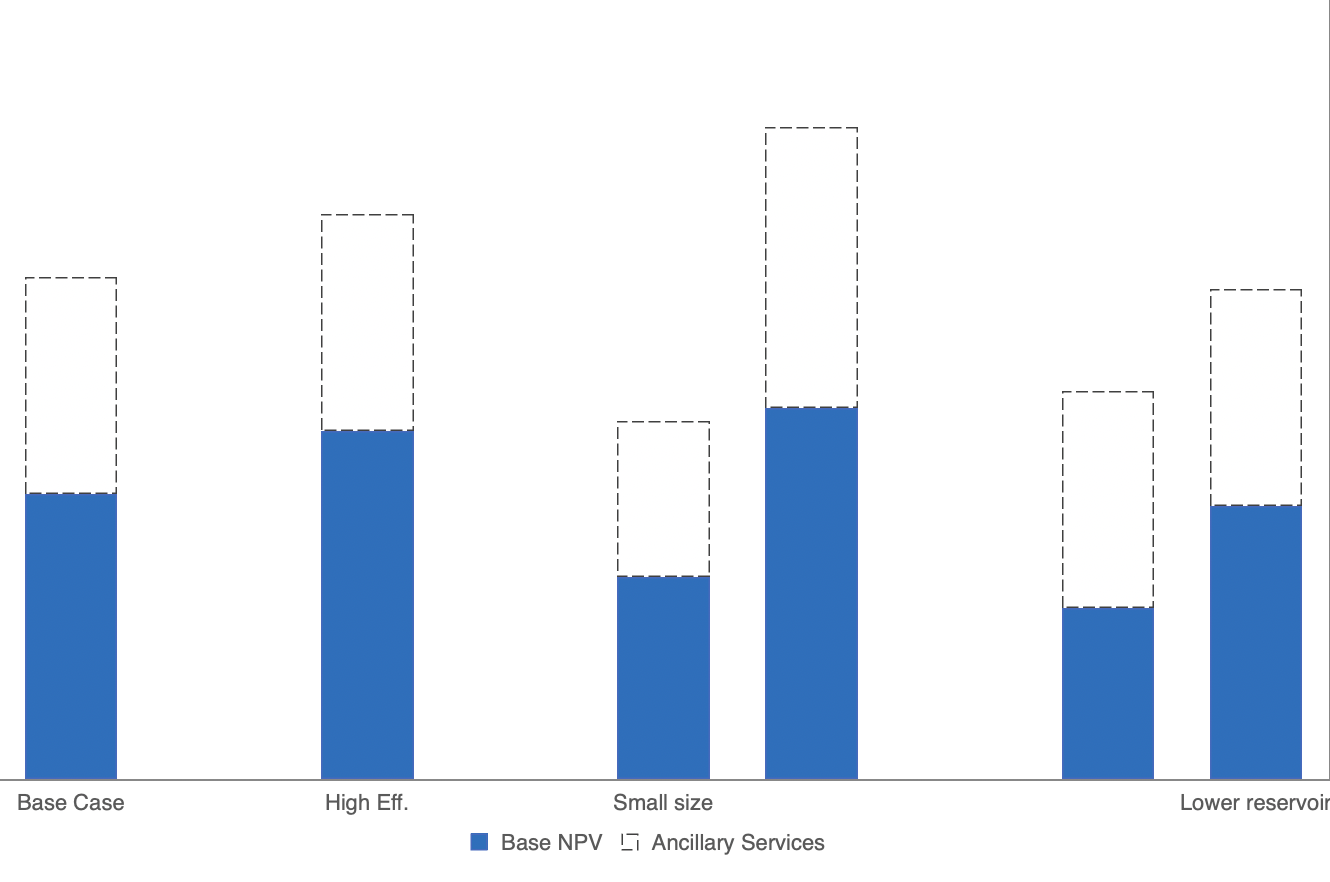

In terms of dimensioning, we proposed a different power plant setup with a more efficient reversible turbine and a larger reservoir which combined delivered an extra net present value of € 90 Mn.

Cash flow – USD/y

Net Present Value (unlevered) – Mn. EUR

Net Present Value (unlevered) – Mn. EUR